Best Guaranteed Installment Loans Online For Bad Credit Lenders Same Day Approval 2024

Installment loans are suitable if you want to borrow money and pay it off in fixed payments. Installment loans allow you to borrow what you need and repay conveniently in fixed payments over several weeks or months. With installment loans online, you know exactly how much you owe monthly, making them more manageable. Thanks to options like installment loans for bad credit, you can access the funding you need without worrying about your credit score. Best of all, it has never been easier to access online installment loans from direct lenders, thanks to loan providers. Loan providers offer a fast and convenient loan process with inclusive criteria and quick funding for different installment loans no credit check alternatives.

These include personal installment loans, no credit check installment loans alternatives, and online installment loans for bad credit. This guide presents our editor’s picks of top loan providers you can use to apply for different installment loans bad credit from direct lenders likely to approve your application. Read on to discover what they offer, the eligibility criteria, pros and cons, and how to apply for personal installment loans for bad credit through a few simple steps.

Online Installment Loans Instant Approval ✅ Quick Overview

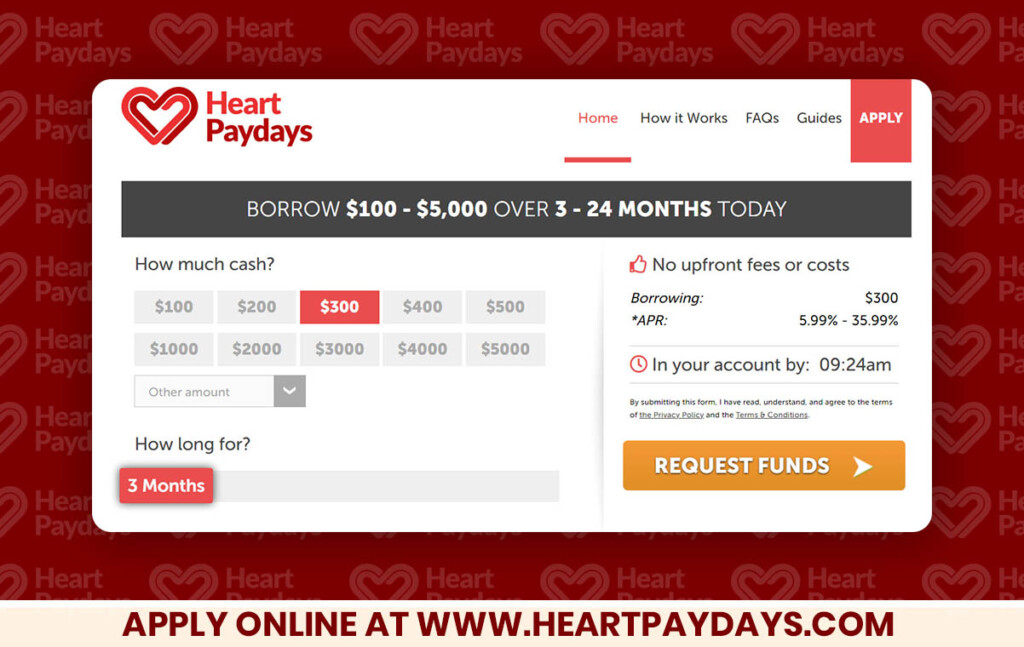

- Heart Paydays: Overall Best for Installment Loans Online up to $5k

- Big Buck Loans: Recommended for Installment Loans for Bad Credit Borrowers

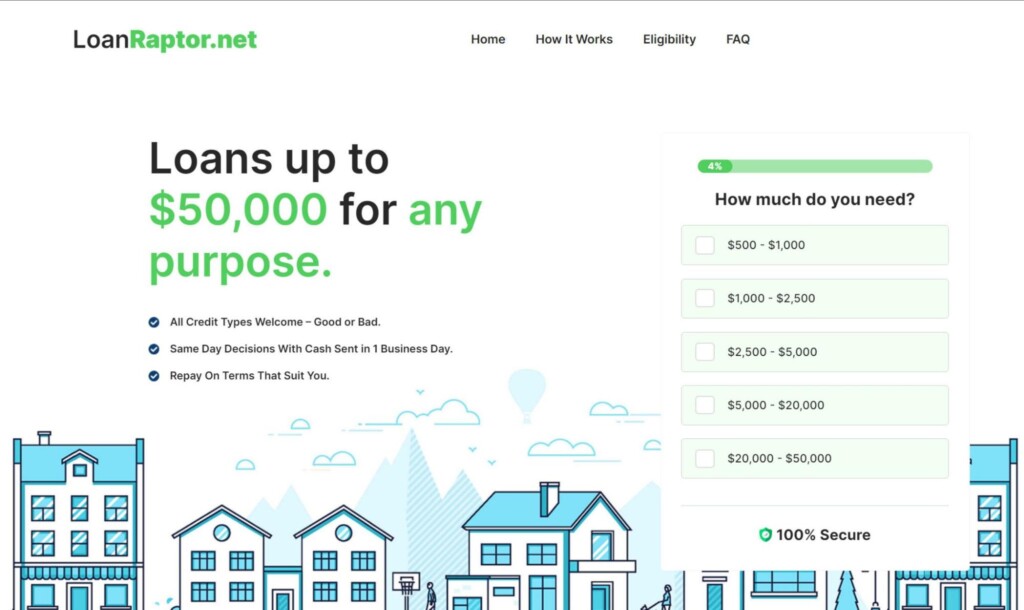

- Loan Raptor: Ideal for Online Installment Loans with 10+ Years to Pay

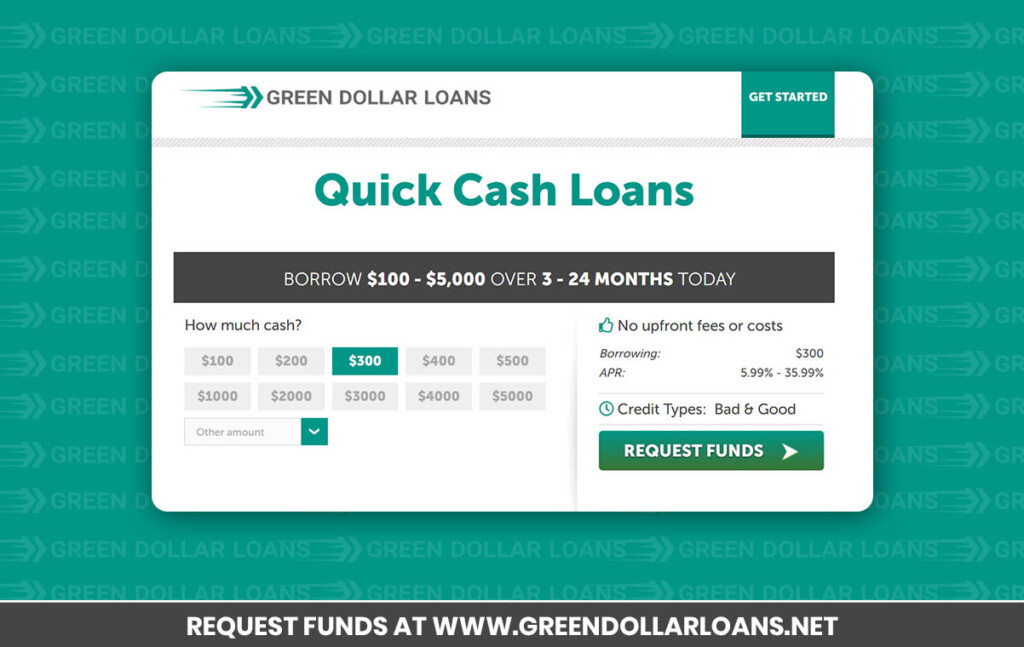

- Green Dollar Loans: Ideal for 100% Digital Application for Installment Loans No Credit Check Alternatives

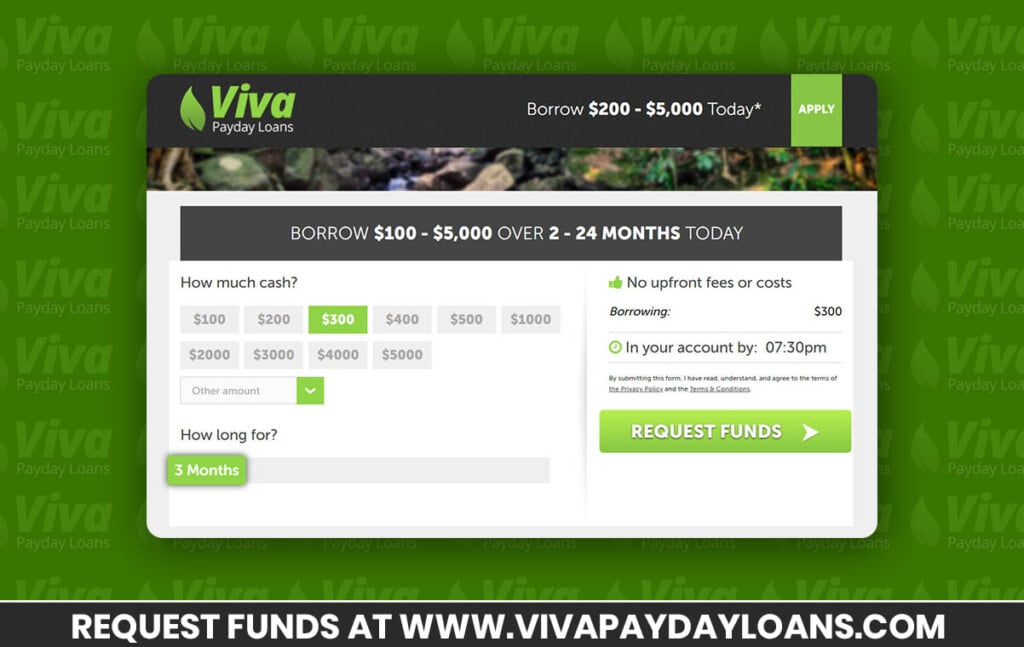

- Viva Payday Loans: Best for Personal Installment Loans with 2 to 24 Months to Pay

Top 5 Most Trusted Installment Loan Providers For Bad Credit Guaranteed Approval 2024 – Full Reviews

Heart Paydays: Overall Best for Installment Loans Online up to $5k

Heart Paydays ticks all the right boxes for quick funding without hidden fees or red tape. It features a fast and easy application process that lets you capture your details and get matched to direct lenders offering up to $5,000 with easy repayment terms.

Eligibility Criteria for Installment Loans Online up to $5k

- 18+ years of age

- US citizen/resident

- Stable income

Pros

- Quick funding

- Fast and easy online applications

- Easy repayments

Cons

- High APRs.

Big Buck Loans: Recommended for Installment Loans for Bad Credit Borrowers

Big Buck Loans welcomes borrowers with all types of credit scores and offers some of the best installment loans for bad credit borrowers. It features a streamlined loan process, fast turnarounds, affordable amounts from $100 to $5,000, and flexible terms.

Eligibility Criteria for Installment Loans for Bad Credit

- Minimum age of 18 years

- Government-issued ID

- Legal US citizen/resident

Pros

- Borrow money with bad credit

- Fast turnarounds

- Affordable amounts

Cons

- Missed payment penalty

Loan Raptor: Ideal for Online Installment Loans with 10+ Years to Pay

If you’re looking for substantial amounts, look no further than Loan Raptor. It features a hassle-free online process that connects you to direct lenders offering high loan amounts with immediate feedback, quick payouts, and extended repayments of 10+ years.

Eligibility Criteria for Online Installment Loans

- At least 18 years of age

- Stable income for 3+ months

- Proof of ID and address

Pros

- High loan amounts

- Immediate feedback

- Extended repayments

Cons

- Costly APRs.

Green Dollar Loans: Ideal for 100% Digital Application for Installment Loans No Credit Check Alternatives

Green Dollar Loans champions convenient borrowing and allows you to apply for loans from the comfort of your home. You can apply from anywhere and get access to direct lenders offering small to medium-sized amounts with swift disbursements no matter your credit score.

Eligibility Criteria for Installment Loans No Credit Check Alternatives

- Legal above 18

- A valid form of ID

- US citizenship/residency

Pros

- Apply from anywhere

- Small to medium-sized amounts

- Swift disbursements

Cons

- Expensive APRs

Viva Payday Loans: Best for Personal Installment Loans with 2 to 24 Months to Pay

If you’re tired of complicated loan processes, check out Viva Payday Loans. It features a streamlined online process that allows you to apply in minutes and connect to direct lenders with inclusive terms, affordable amounts from $100 to $5,000, and flexible repayments from 2 to 24 months.

Criteria for Personal Installment Loans

- 18 years and above

- Proof of stable income

- Pass the affordability assessment

Pros

- Apply in minutes

- Affordable amounts

- Flexible repayments

Cons

- APRs can reach 35.99%

What Are Alternatives to No Credit Check Installment Loans?

Alternatives to no credit check installment loans are personal loans that allow you to access a lump sum sent directly into your account after finalizing the loan process. You can borrow the amount you need, use it however you like, and pay it off over a few months or years through fixed payments that don’t change over the loan period.

To apply for alternatives to no credit check installment loans, simply capture your details to help lenders verify that you qualify. Most lenders consider more than your credit score and focus on whether or not you can afford to repay the amount you borrow.

Types of No Credit Check Installment Loans Alternatives?

Online Installment Loans for Bad Credit

These are suitable if you want to borrow without worrying about your credit score.

No-Collateral Installment Loans Bad Credit

With no collateral installment loans bad credit, you don’t need to provide any valuable asset as security.

Personal Installment Loans for Bad Credit Up to $5K

Personal installment loans for bad credit up to $5K are suitable if you need to borrow a medium-sized amount with low or non-existent credit.

Bad Credit Installment Loans Guaranteed Approval or Denial Within Minutes

These are suitable if you need to borrow money quickly and feature feedback within 2 minutes.

How to Apply for Bad Credit Installment Loans?

Step 1: Select the Desired Loan Amount and Term

Choose a suitable amount from $100 to $5,000 and how long you need to repay, from 3 to 24 months.

Step 2: Finalize the Online Application Form

Fill in the online form with your personal, employment, income, and monthly expenditure details and hit the submit button.

Step 3: Get Quick Feedback on Bad Credit Installment Loans

You’ll receive feedback within 2 minutes after submitting the completed form. A suitable lender will send you a loan contract. Ensure you read it carefully, then sign and return it.

Step 4: Receive Quick Payouts on Online Installment Loans Instant Approval Alternatives

Lenders are quick with payouts and will disburse the approved amount as soon as possible.

How We Chose Installment Loans Online No Credit Check Alternatives Providers

We selected providers offering:

- Easy qualification criteria

- 100% online process

- Inclusive lending

- Flexible amounts and repayments

FAQs

What APR Will I Get with Installment Loans California?

You can expect an APR from 5.99% to 35.99% when you apply through any of the above platforms. Your APR will depend on factors like the lender, credit score, loan amount, and term. When you apply through the above loan providers, you can increase your chances of getting the lowest APR possible thanks to competition among lenders.

How Much Can I Borrow with Tribal Installment Loans?

Depending on your affordability, you can borrow from $100 to $5,000 or up to $50,000 among some lenders. Ensure you only borrow an amount you can realistically repay based on your income and budget.

Can I Borrow Instant Funding Installment Loans when Unemployed?

Yes! Some lenders specialize in helping unemployed borrowers access the funding they need. You only need to have an alternate income source and prove easy affordability. Alternate income sources include self-employment income, freelance earnings, pensions, rental income, dividends, government benefits, stocks, and bonds.

How Will I Repay Unsecured Installment Loans with No Credit Check Alternatives?

The lender will set up an automatic debit on your account once you complete the loan process and sign the agreement. It will deduct the due amount once your salary or income enters the account, and this can be weekly, fortnightly, or monthly, depending on your preferences or when you get paid.

Can I Get Guaranteed Installment Loans for Bad Credit?

Legitimate lenders cannot offer guaranteed loans because all borrowers are different, and they must first determine your eligibility and affordability. If you’re worried about how your credit will affect your application, don’t be. Some specialized lenders consider more than your credit and focus on whether or not you can repay the amount you borrow in full and on time.

How Do Lenders Determine Affordability for Installment Loans for Bad Credit Online?

Lenders determine affordability by comparing your monthly income with your monthly expenditure and determining how much you have left over for loan repayments. You can improve your affordability by reducing your monthly expenses, increasing your income, or borrowing an amount you can realistically afford.

Best Installment Loans For Bad Credit

Top 5 Best Installment Loans For Bad Credit USA (2024) With Guaranteed Approval from Direct Lenders

Disclaimer: The loan websites reviewed are loan-matching services, not direct lenders, therefore, do not have direct involvement in the acceptance of your loan request. Requesting a loan with the websites does not guarantee any acceptance of a loan. This article does not provide financial advice. Please seek help from a financial advisor if you need financial assistance. Loans available to US residents only.